QuickLinks-- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(RULE 14a-101)

Schedule

SCHEDULE 14A

InformationINFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment No.

(Amendment No.____ )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | | |

Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ýx |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| o | Soliciting Material Pursuant to § 240.14a-12 |

Central European Media Enterprises Ltd.

____________________

(Name of Registrant as Specified in its Charter)

____________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | | | |

Central European Media Enterprises Ltd. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required.required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies:

|

| (2) | | Aggregate number of securities to which transaction applies:

|

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| (4) | | Proposed maximum aggregate value of transaction:

|

| o | Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

(1) |

|

Amount Previously Paid:

|

| (2) | | Form, Schedule or Registration Statement No.:

|

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

NOTICE OF

SPECIALANNUAL GENERAL MEETING OF SHAREHOLDERS

A Special

The Annual General Meeting of Shareholders of CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

("(the “Companywe" or the "Company"”), a Bermuda company, will be held at Citco (Bermuda) Limited, O'HaraO’Hara House, 3 Bermudiana Road, Hamilton, HM08HM 08 Bermuda on April 14,June 2, 2014 at 1010:30 a.m. for the following purposes:1.to amend the Company's Bye-laws and the conditions of its Memorandum to increase the authorized share capital of the Company from $25.6 million to $36.8 million by increasing the number of authorized shares of Class A Common Stock from 300,000,000 shares to 440,000,000 shares of par value $0.08 each; and

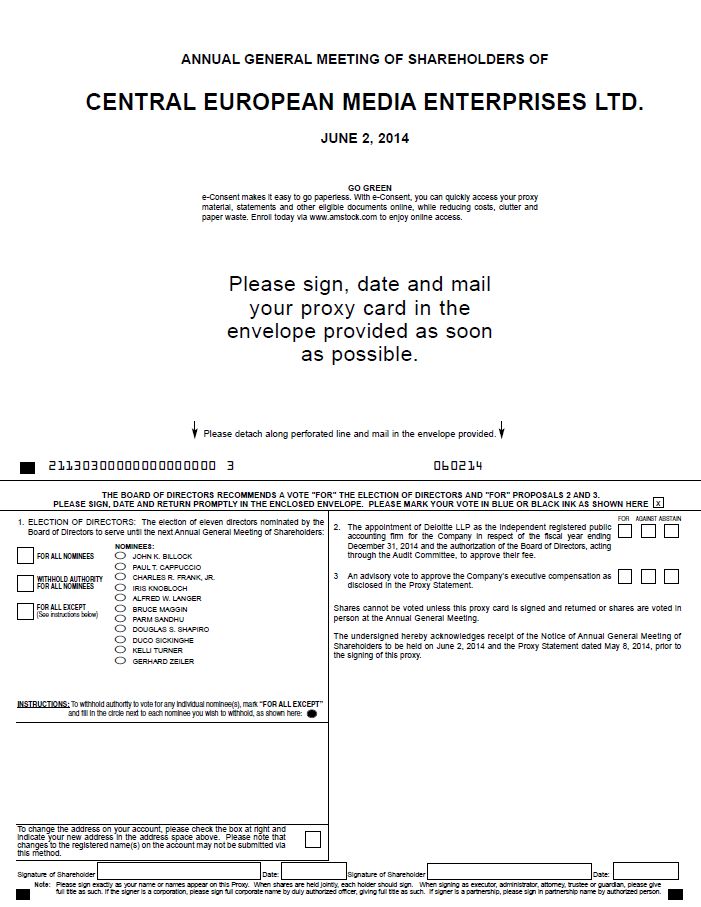

| 1. | to elect eleven directors to serve until the next Annual General Meeting of Shareholders; |

2.to approve (a) the issuance by the Company of non-transferable rights (the "Rights Offering") to shareholders of record as of the Rights Offering record date and (b) the issuance to Time Warner Media Holdings B.V. of (i) a warrant exercisable for 30,000,000 shares of Class A Common Stock, subject to adjustment in accordance with the terms thereof and (ii) warrants exercisable for up to 84,000,000 shares of Class A Common Stock, subject to adjustment in accordance with the terms thereof. | 2. | to appoint Deloitte LLP as the independent registered public accounting firm for the Company in respect of the fiscal year ending December 31, 2014 and to authorize the directors, acting through the Audit Committee, to approve their fee; and |

| 3. | to conduct an advisory vote to approve the Company’s executive compensation. |

The approval and adoption of each matter to be presented to the shareholders is independent of the approval and adoption of each other matter to be presented to the shareholders.

Only shareholders of record at the close of business on

March 21,May 8, 2014 are entitled to notice of and to vote at the

meeting and any adjournments thereof. March 21, 2014

meeting.

IMPORTANT

| By order of the Board of Directors, |

| |

| Daniel Penn |

| Secretary |

| May 8, 2014 | |

IMPORTANT: The prompt return of proxies will ensure that your shares will be voted. A self-addressed envelope is enclosed for your convenience.

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

PROXY STATEMENT FOR

SPECIALANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD

APRIL 14,JUNE 2, 2014

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of CENTRAL EUROPEAN MEDIA ENTERPRISES LTD. (the

"“CompanyCompany"”), a Bermuda company, for use at a Specialthe Annual General Meeting of Shareholders (the "“MeetingMeeting"”) to be held at Citco (Bermuda) Limited, O'HaraO’Hara House, 3 Bermudiana Road, Hamilton, HM 08 Bermuda on April 14,June 2, 2014 at 1010:30 a.m., and at any adjournments thereof.

Shareholders may vote their shares by signing and returning the proxy card accompanying this proxy statement. Shareholders who execute proxies retain the right to revoke them at any time by notice in writing to the Company Secretary, by revocation in person at the Meeting or by presenting a later-dated proxy. Unless so revoked, the shares represented by proxies will be voted at the Meeting in accordance with the directions given therein. Shareholders vote at the Meeting by casting ballots (in person or by proxy). The presence, in person or by proxy, of shareholders entitled to cast at least a majority of the total number of votes entitled to be cast at the Meeting constitutes a quorum. Abstentions and broker

"non-votes"“non-votes” are included in the determination of the number of shares present at the Meeting for quorum purposes, but abstentions and broker

"non-votes"“non-votes” are not counted in the tabulations of the votes cast on proposals presented to shareholders. A broker

"non-vote"“non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

Our registered office is located at

O'HaraO’Hara House, 3 Bermudiana Road, Hamilton, HM 08 Bermuda. A subsidiary of the Company maintains offices at

KrizeneckéKřiženeckého námestíměstí 1078/5, 152 00 Prague 5, Czech Republic. The date on which this proxy statement and the enclosed form of proxy will first be sent to shareholders is on or about

March 24,May 12, 2014.

At the close of business on March 21, 2014 (the record date) there were issued and outstanding 135,126,867 shares of Class A Common Stock, par value $0.08 per share (the "Class A Common Stock").

Shareholders of record of our Class A Common Stock, par value $.08 per share, at the close of business on March 21,May 8, 2014 shall be entitled to one vote for each share then held. At the close of business on March 21,May 8, 2014 one sharethere were issued and outstanding 135,141,367 shares of Class A Common Stock. The shareholder of record of our Series A Convertible Preferred Stock, par value $0.08$.08 per share, (the "Series A Preferred Stock"), was issued and outstanding. The shareholderat the close of record of our Series A Preferred Stockbusiness on the record dateMay 8, 2014 shall be entitled to one vote for each of the 11,211,449 shares of Class A Common Stock into which it is convertible. At the close of business on March 21,May 8, 2014, one share of our Series A Convertible Preferred Stock was issued and outstanding. At the close of business on May 8, 2014, no shares of our Class B Common Stock were issued and outstanding.

PROPOSAL 1

INCREASE IN THE AUTHORIZED SHARE CAPITAL BY

INCREASING THE NUMBER

ELECTION OF AUTHORIZEDDIRECTORS

SHARES OF CLASS A COMMON STOCK At present,

Eleven directors are to be elected at the

Company's Bye-laws and Memorandum state that the authorized share capital2014 Annual General Meeting to serve until our next annual general meeting of

the Company is $25.6 million, divided into three classes of shares: 300,000,000 shares of Class A Common Stock, par value $0.08 per share, 15,000,000 shares of Class B Common Stock, par value $0.08 per share, and 5,000,000 shares of Preferred Stock, par value $0.08 per share (the "Preferred Stock"). As of March 21, 2014, 135,126,867 shares of Class A Common Stock were issued and outstanding, 11,211,449 shares of Class A Common Stock were reserved for issuance upon the conversion of the outstanding share of Series A Preferred Stock, 85,176,305 shares of Class A Common Stock were reserved for issuance upon the conversion of the outstanding shares of Series B Convertible Redeemable Preferred Stock (the "Series B Preferred Stock"), 13,407,489 shares of Class A Common Stock were reserved for issuance upon the conversion of the Company's outstanding senior convertible notes due 2015, and 4,972,862 shares of Class A Common Stock were reserved for issuance upon the exercise of stock options, restricted stock units and warrants. Accordingly, thereshareholders. The 11 nominees are currently 50,105,028 shares of Class A Common Stock thatlisted below together with brief biographies. All nominees are unissued and not reserved for issuance. As of March 21, 2014, no shares of Class B Common Stock were reserved for issuance, leaving 15,000,000 shares of Class B Common Stock unissued and not reserved for issuance. As of March 21, 2014, one share of the Company's Series A Preferred Stock was issued and outstanding and 200,000 shares of the Company's Series B Preferred Stock were issued and outstanding, leaving 4,799,999 shares of Preferred Stock unissued and not reserved for issuance.

The disinterested directors, on behalf of the Board of Directors of the Company, have determined that it is in the best interests of the Company and its shareholders to increase the authorized share capital from $25.6 million to $36.8 million by increasing the number of authorized shares of Class A Common Stock from 300,000,000 shares to 440,000,000 shares.incumbents. The Board of Directors has determined that seven of the authorizationcurrent directors qualify as independent under the NASDAQ Marketplace Rules: John Billock, Charles Frank, Alfred Langer, Bruce Maggin, Parm Sandhu, Duco Sickinghe and Kelli Turner. At this time the Board of Directors knows of no reason why any nominee might be unable to serve as a director.

Director Nominees

John K. Billock, 65, has served as a Director and as our Chairman of the Board since April 15, 2014. Mr. Billock is a member of the Board of Advisors of Simulmedia, Inc. He served as a Director of TRA Inc. and TiVo Research and Analytics, Inc. from 2007 to 2011 and as a Director of Juniper Content Corporation from January 2007 to December 2008. From October 2001 until July 2005, he was Vice Chairman and Chief Operating Officer of Time Warner Cable Enterprises LLC. Before joining Time Warner Cable, Mr. Billock was with Home Box Office from 1978 to 2001 and served as President of its US Network Group from 1997 to 2001 and President of Sales and Marketing from 1995 to 1997. Before joining HBO, Mr. Billock was a product manager with Colgate Palmolive Company. Mr. Billock received a BA degree in English and Religion from Wesleyan University and an MBA from Boston University. Mr. Billock brings to our Board experience from his many years in the media industry as well as extensive executive management experience.

Paul T. Cappuccio, 52, has served as a Director since October 2009. Mr. Cappuccio has been Executive Vice President and General Counsel of Time Warner Inc. since January 2001, in which capacity he oversees the worldwide management of Time Warner Inc.'s legal functions, collaborating with all of its operating businesses. From August 1999 until January 2001, Mr. Cappuccio was Senior Vice President and General Counsel at America Online. Before joining AOL, Mr. Cappuccio was a partner at the Washington, D.C. office of Kirkland & Ellis, one of the world's premier litigation and transactional law firms, where he specialized in telecommunications law, appellate litigation and negotiation with government agencies. From 1991 until 1993, Mr. Cappuccio was Associate Deputy Attorney General at the United States Department of Justice, where he advised Attorney General William P. Barr on matters relating to judicial selection, civil litigation, antitrust and civil rights. Prior to his service at the Justice Department, Mr. Cappuccio served as a law clerk at the Supreme Court of the United States and as a law clerk to Judge Alex Kozinski of the United States Court of Appeals for the Ninth Circuit in Pasadena, California. He is a 1986 graduate of Harvard Law School and a 1983 graduate of Georgetown University. Mr. Cappuccio, as general counsel of a global media company, brings significant large public company experience to our Board, including transactional and corporate governance expertise.

Charles R. Frank, Jr., 76, served as a Director from 2001 until July 2009 and from March 2010 to the present. From July 2009 through February 2010, Mr. Frank served as interim Chief Financial Officer of the Company. Mr. Frank currently serves as a member of the Advisory Committee of the Sigma-Bleyzer Growth Fund IV. From 1997 to 2001, Mr. Frank was First Vice President and twice acting President of the European Bank for Reconstruction and Development, which makes debt and equity investments in Central and Eastern Europe and the former Soviet Union. From 1988 to 1997, Mr. Frank was a Managing Director of the Structured Finance Group at GE Capital and a Vice President of GE Capital Services. Mr. Frank served as Chief Executive Officer of Frank and Company from 1987 to 1988, and Vice President of Salomon Brothers from 1978 until 1987. Mr. Frank has held senior academic and government positions, including Deputy Assistant Secretary of State and Chief Economist at the U.S. Department of State, Senior Fellow at the Brookings Institution, Professor of Economics and International Affairs at Princeton University, and Assistant Professor of Economics at Yale University. Mr. Frank graduated from Rensselaer Polytechnic Institute with a B.S. in mathematics and economics before completing a Ph.D. in economics at Princeton University. Mr. Frank brings to the Board 35 years’ experience in the financial services industry, including 17 years relating to Central and Eastern Europe, as well as notable senior management experience.

Iris Knobloch, 50, has served as a Director since April 15, 2014. She has served as President of Warner Bros. France S.A. since 2006, in which capacity she oversees all of Warner Bros.’ business in France, including theatrical production and distribution, television distribution, home video, games, consumer products, online and emerging distribution technologies as well as Warner Bros.’ Home Entertainment business in the Benelux. She is also an independent director of Accor S.A. From 2001 to 2006, she served as Senior Vice President of International Relations of Time Warner Inc. From 1996 to 2001, Ms. Knobloch was Vice President of Business and Legal Affairs for Warner Home Video’s European management team in London, Los Angeles and Paris. Prior to that, Ms. Knobloch practiced law with Norr, Stiefenhofer & Lutz and O’Melveny & Myers, where she provided strategic counsel on international transactions to major U.S. and European media and entertainment clients. Ms. Knobloch received a J.D. degree from Ludwig-Maxmilians-Universitaet in Munich, Germany in 1987 and L.L.M. degree from New York University in 1992. Ms. Knobloch brings to our Board deep understanding of the media industry, particularly in Europe, as well as significant executive management experience.

Alfred W. Langer, 63, has served as a Director since 2000. Mr. Langer currently serves as a consultant to a number of privately held companies, primarily in Germany, in the areas of mergers and acquisitions, structured financing and organizational matters. From July 2001 until June 2002, Mr. Langer served as Chief Financial Officer of Solvadis AG, a German based chemical distribution and trading company. From October 1999 until May 2001, Mr. Langer served as Treasurer of Celanese AG, a German listed chemical company. From June 1997 until October 1999, Mr. Langer served as Chief Financial Officer of Celanese Corp., a U.S. chemical company. From October 1994 until July 1997, Mr. Langer served as Chief Executive Officer of Hoechst Trevira GmbH, a producer of synthetic fibers. From 1988 until September 1994, Mr. Langer served as a member of the Board of Management of Hoechst Holland N.V., a regional production and distribution company. Mr. Langer received an M.B.A. degree from the University GH Siegen. Mr. Langer brings to our Board and Board committees substantial financial and financial reporting expertise.

Bruce Maggin, 71, has served as a Director since 2002. Mr. Maggin has served, since its inception, as Managing Partner and Principal of the H.A.M Media Group, LLC, an international investment and advisory firm he founded in 1997 that specializes in the entertainment and communications industries. Until 2009, he also served as Executive Vice President and Secretary of Media and Entertainment Holdings, Inc. and was a Director of the company from 2005 until 2007. From 1999 to 2002, Mr. Maggin served as Chief Executive Officer of TDN Media, Inc., a joint venture between Thomson Multimedia, NBC Television and Gemstar-TV Guide International that sold advertising on proprietary interactive television platforms. Prior to that, Mr. Maggin had a long career with Capital Cities/ABC serving in a variety of financial and operational roles culminating as Head of the Multimedia Group, one of the company’s five operating divisions. He also represented Capital Cities/ABC on the Board of Directors of several companies, including ESPN, Lifetime Cable Television and In-Store Advertising, among others. Mr. Maggin has been a Director of PVH Corp. since 1987 and Chairman of its Audit Committee since 1997. Mr. Maggin is a member of the Board of Trustees of Lafayette College, from which he received a B.A. degree. He also earned J.D. and M.B.A. degrees from Cornell University. Mr. Maggin’s qualifications to serve on our Board and Board committees include his long career as a corporate financial executive, chief operating officer and private investor in the media industry, as well as his service as a director and chairman of the audit and compensation committees of several companies.

Parm Sandhu, 45, has served as a Director since September 2009. Mr. Sandhu is a non-executive director of Eircom, Ireland’s incumbent telecoms service provider and Chairman of Merapar, an early stage European media and technology investment fund and advisory firm. He served as Chief Executive Officer of Unitymedia, Europe’s third largest cable operator, from 2003 to 2010. Prior to that, Mr. Sandhu was a Finance Director with Liberty Media International, where he pursued numerous strategic acquisitions, and held a number of senior finance and strategy positions during his six years with Telewest Communications plc. Before entering the technology, media and telecommunications sector, Mr. Sandhu worked at PricewaterhouseCoopers in London, where he qualified as a Chartered Accountant. He is a graduate of Cambridge University and holds a first class MA Honours degree in Mathematics. Mr. Sandhu brings to the Board and Audit Committee significant executive management experience in the European media and telecoms sector and considerable expertise in the cable industry, as well as extensive knowledge of financial and accounting matters.

Douglas S. Shapiro, 45, has served as a Director since April 15, 2014. Mr. Shapiro has been Senior Vice President of International and Corporate Strategy at Time Warner Inc. since September 2013. From 2008 to September 2013, he ran the Time Warner Investor Relations group. Before joining Time Warner, from 1999 to 2007, Mr. Shapiro was the senior analyst covering the cable and satellite TV and media conglomerate sectors at Banc of America Securities and was the head of the Media and Telecommunications research team. Prior to that, he was the senior analyst covering the cable and satellite communications sectors at Deutsche Banc Securities. Early in his career, he also served as an economic consultant at KPMG Peat Marwick and as an economist at the U.S. Department of Labor. Mr. Shapiro received a B.A. degree in economics from the University of Michigan and is a Chartered Financial Analyst. Mr. Shapiro brings to the Board his broad experience in television distribution, public equity capital markets, including investor relations in a publicly traded global media company, and corporate strategy.

Duco Sickinghe, 56, has served as a Director since October 2008. From 2001 to March 2013 he was the Chief Executive Officer and Managing Director of Telenet Group Holding N.V. (“Telenet”), the Flemish cable operator. Mr. Sickinghe has worked in the technology and media industries for over 25 years, and began his career in finance with Hewlett-Packard at its European headquarters in Switzerland in 1987. In 1987, Mr. Sickinghe moved to Germany to head up Hewlett-Packard's LaserJet product line for Europe, and in 1989 became the company's Channel Development Manager for Europe. In 1991, Mr. Sickinghe joined NeXT Computer as Vice President Marketing, then as General Manager France. Mr. Sickinghe was a co-founder of Software Direct in 1994 and served as its Chief Executive Officer until 1997. Software Direct later became a joint venture with Hachette Distributions Services. Mr. Sickinghe joined Wolter-Kluwer Professional Publishing in 1997 and, as General Manager of Kluwer Publishing in The Netherlands, oversaw its transition to electronic media and reengineered the company’s traditional business. In early 2001, he joined Cable Partners Europe and was appointed as Chief Executive Officer of Telenet in the summer of 2001. Mr. Sickinghe is also a member of the Board of Directors of European Assets Trust (United Kingdom) and Chairman of the Board of B.V. Belegging en Handelmaatschappij van Eeghen (The Netherlands), and served as a director of Zenitel NV from 2006 to 2012. Mr. Sickinghe holds a Dutch Master’s Degree in law and an M.B.A. from Columbia University. Mr. Sickinghe’s qualifications for our Board include his experience as a principal executive officer of a number of media and technology companies and his knowledge of the complex financial and operational issues facing technology and media companies.

Kelli Turner, 43, has served as a Director since May 2011. She is general partner of RSL Venture Partners, a venture capital fund whose principal investor is Ronald Lauder. She was previously President and Chief Financial Officer of RSL Management Corporation from February 2011 to April 2012. Ms. Turner previously was Chief Financial Officer and Executive Vice President of Martha Stewart Living Omnimedia, Inc. (“MSLO”), a diversified media and merchandising company, from 2009 to 2011, where she was responsible for all aspects of the company’s financial operations, while working closely with the executive team in shaping MSLO’s business strategy and capital allocation process. She also had oversight responsibility for financial planning, treasury, financial compliance and reporting, and investor relations, as well as key administrative functions. A lawyer and a CPA with significant experience in the media industry, Ms. Turner joined MSLO in 2009 from Time Warner Inc., where she held the position of Senior Vice President, Operations in the Office of the Chairman and CEO. Prior to that, she served as SVP, Business Development for New Line Cinema from 2006 to 2007 after having served as Time Warner Inc.’s Vice President, Investor Relations from 2004 to 2006. Ms. Turner worked in investment banking for many years with positions at Allen & Company and Salomon Smith Barney prior to joining Time Warner Inc. Early in her career, she also gained tax and audit experience as a registered CPA at Ernst & Young, LLP. Ms. Turner received her undergraduate business degree and her law degree from The University of Michigan. Ms. Turner brings to our Board a strong financial and business background in the media industry. Gerhard Zeiler, 58, has served as a Director since April 15, 2014. Since 2012 Mr. Zeiler has served as President of Turner Broadcasting System, Inc., a Time Warner affiliate. He has been non-executive chairman of GAGFAH S.A., one of the largest residential property companies listed in Germany, since March 2014. Prior to joining Turner Broadcasting, he was Chief Executive Officer of RTL Group from 2003 to 2012 and a member of the executive board of international media group Bertelsmann SE & Co. KGaA from 2005 to 2012. Mr. Zeiler was Chief Executive Officer of RTL Television from 1998 to 2005 and Chief Executive Officer of ORF, the Austrian broadcasting corporation, from 1994 until 1998. Before that, he was Director General of Austria’s public broadcaster, ORF, from 1994 to 1998, Chief Executive Officer of RTL II from 1992 to 1994, Chief Executive Officer of Tele 5 from 1991 to 1992, and Secretary General of ORF from 1986 to 1990. He started his career as a journalist and later spokesman for two Austrian Chancellors. Mr. Zeiler brings to our Board his extensive experience in television broadcasting in Europe as the principal executive officer of two major media companies.

There is no arrangement or understanding between any director and any other person pursuant to which such person was selected as a director other than Paul T. Cappuccio, who was nominated by Time Warner Inc. pursuant to the terms of an

additional 140,000,000 sharesinvestor rights agreement dated as of

Class A Common Stock will provideMay 18, 2009, as amended, among the Company,

with flexibility in the future by assuring that there will be sufficient authorized shares of Class A Common Stock to enable the Company to issue shares in connection with (a) the exercise of unit warrants exercisable for shares of Class A Common Stock to be issued in the Rights Offering, (b) the exercise of (x) the warrant exercisable for 30,000,000 shares of Class A Common Stock (subject to adjustment in accordance with the terms thereof) and (y) warrants exercisable for up to 84,000,000 shares of Class A Common Stock (subject to adjustment in accordance with the terms thereof) pursuant to (i) the backstop of the Rights Offering by Time Warner Media Holdings B.V.

("TW BV") and a separate private placement to TW BV or (ii) a term loan agreement withcertain other parties and Iris Knobloch, Douglas Shapiro and Gerhard Zeiler , who were also nominated by Time Warner Inc., each pursuant to the terms of a framework agreement dated as described in Proposal 2, (c) any new debt or equity financing requirements, future acquisitions or mergers, stock dividends or splits, employee compensation programsof February 28, 2014, among the Company, Time Warner Inc. and (d) for other corporate purposes.Time Warner Media Holdings B.V.

Vote Required; Recommendation

The

unreserved and unissued shareselection of

Class A Common Stock may be issued at such times, for such purposes and for such consideration as the Board of Directors

of the Company may determine to be in the best interests of the Company and its shareholders and, except as otherwise required by applicable law, without further authority from the shareholders of the Company. A copy of the amended Section 3(1) of the Bye-laws is set forth in Exhibit A. The amendment to our Bye-laws and the conditions of its Memorandum to increase the authorized share capital and the number of authorized shares will not have any immediate effect on the rights of existing shareholders. However, our Board of Directors will have the authority to issue authorized stock without requiring future shareholder approval of such issuances, except as may be required by

applicable law or exchange regulations. To the extent that additional authorized shares are issued in the future, they will decrease the percentage equity ownership of existing shareholders, could decrease existing shareholders' voting power, and, depending upon the price at which they are issued, could be dilutive to the existing shareholders.

Preemptive Rights

TW BV is a beneficial owner of shares of the Company's Class A Common Stock, Series A Preferred Stock and Series B Preferred Stock. Pursuant to an amended Investor Rights Agreement by and among Time Warner Inc., RSL Savannah LLC, Ronald S. Lauder, RSL Investments LLC, RSL Investments Corporation and the Company, the Company has granted TW BV, and any of its permitted transferees, certain preemptive rights with respect to future issuances of the Company's equity securities (subject to certain exclusions).

No Appraisal Rights

Under Bermuda law and the Company's Bye-laws, holders of the Company's Class A Common Stock and Series A Preferred Stock will not be entitled to dissenter's rights or appraisal rights with respect to the authorized share increase.

Vote Required; Recommendation

The Bye-laws provide that the Company may from time to time, by ordinary resolution passed by the holders of common shares, increase its capital by such sum, to be divided into shares of such amounts, as the resolution shall prescribe. Adoption of an ordinary resolution to increase the share capital as described in this Proposal 1 requires the affirmative vote of a majority of the votes cast, in person or by proxy, at the Meeting, provided that a quorum is present in person or by proxy. Abstentions and broker non-votes will be included in determining the presence of a quorum, but are not counted as votes cast.

TW BV, which holds 49.6% of the voting power of our shares as of the record date for the Meeting, has agreed to vote in favor of this Proposal 1.

Unless otherwise indicated, the accompanying form of Proxy will be voted FOR the adoption of the amendment to the Company's Bye-laws and the conditions of its Memorandum to increase the authorized share capital of the Company from $25.6 million to $36.8 million by increasing the number of authorized shares of Class A Common Stock from 300,000,000 shares to 440,000,000 shares.

THE DISINTERESTED DIRECTORS, ON BEHALF OF THE BOARD OF DIRECTORS OF THE COMPANY, UNANIMOUSLY RECOMMEND A VOTE IN FAVOR OF THE ADOPTION OF THE AMENDMENT TO THE COMPANY'S BYE-LAWS AND THE CONDITIONS OF ITS MEMORANDUM TO INCREASE THE AUTHORIZED SHARE CAPITAL OF THE COMPANY BY INCREASING THE NUMBER OF AUTHORIZED SHARES OF CLASS A COMMON STOCK.

PROPOSAL 2

APPROVAL OF THE RIGHTS OFFERING AND

THE ISSUANCE OF WARRANTS EXERCISABLE FOR

CLASS A COMMON STOCK

TO

TIME WARNER MEDIA HOLDINGS B.V.

IN ACCORDANCE WITH NASDAQ MARKETPLACE RULE 5635(d)

On February 28, 2014, we announced our intention to conduct the Rights Offering and a series of related financing transactions with TW BV and Time Warner Inc. ("Time Warner" which, unless the context indicates otherwise, includes TW BV and its affiliates other than the Company). The Rights Offering and related financing transactions are being undertaken pursuant to a framework agreement (the "Framework Agreement") dated February 28, 2014 among the Company, TW BV and Time Warner.

As disclosed in the Registration Statement on Form S-3 (File No. 333-194209) filed by the Company with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the "Registration Statement"), including the Prospectus therein, the Company desires to distribute non-transferable rights ("Rights") at no charge to the holders of record as of the Rights Offering record date of the Company's outstanding (a) shares of Class A Common Stock, (b) share of Series A Preferred Stock (allocated on an as-converted basis) and (c) shares of Series B Preferred Stock (allocated on an as-converted basis as of December 25, 2013). The Company intends to distribute one (1) Right for every 62.0102 outstanding shares of Class A Common Stock and every 62.0102 shares of Class A Common Stock issuable upon conversion of the outstanding share of Series A Preferred Stock and upon conversion of the outstanding shares of Series B Preferred Stock (calculated as of December 25, 2013). The Company fixed 5:00 p.m. New York City time on March 21, 2014 as the record date for determining the holders of shares of Class A Common Stock, Series A Preferred Stock and Series B Preferred Stock eligible to participate in the Rights Offering. We refer to the holders of the shares of Class A Common Stock, Series A Preferred Stock and Series B Preferred Stock as of the Rights Offering record date as the "Eligible Securityholders."

We intend for each Right to entitle the holder to purchase, subject to the satisfaction of the minimum subscription amount (as defined below), at the subscription price of one hundred dollars ($100.00) (the "Subscription Price"), one (1) unit (each, a "Unit"), consisting of (a) a 15.0% Senior Secured Note due 2017 (each, a "New Note") in the original principal amount of $100.00 and (b) 21 unit warrants (each, a "Unit Warrant"), with each Unit Warrant entitling the holder to purchase one share of the Company's Class A Common Stock. Eligible Securityholders may only purchase whole Units in denominations of $100.00 per Unit (the "minimum subscription amount"). The Unit Warrants will be exercisable from the second anniversary of their issue date until the fourth anniversary of their issue date at an exercise price of $1.00 per share, subject to the limited right of Time Warner to exercise its Unit Warrants earlier in order to maintain the TW Ownership Threshold (as defined below). The Company is offering 3,418,467 Units in the Rights Offering. The Rights may be exercised at any time during the subscription period stipulated in the Registration Statement, which will commence on April 3, 2014 and expire at 5:00 p.m. New York City time on April 25, 2014, unless otherwise extended by us.

Time Warner has agreed to enter into a standby purchase agreement (the "Purchase Agreement") with the Company prior to the commencement of the Rights Offering. Under the Purchase Agreement, Time Warner will commit, subject to the satisfaction or waiver of certain conditions (described below under "Summary of Transaction Agreements and Warrants"), to exercise in full its subscription privilege at the Subscription Price for all of the Rights allocated to Time Warner in the Rights Offering in respect of its shares of Class A Common Stock, Series A Preferred Stock and Series B Preferred Stock. In addition, the Company has agreed to issue to Time Warner, and Time Warner has agreed to

purchase, 581,533 Units (the "TW Private Placement Units") at the Subscription Price in a private offering to be closed contemporaneously with the Rights Offering (the "TW Unit Private Placement"). The TW Private Placement Units are not included in the Units that the Company is offering in the Rights Offering. The Rights allocated to Time Warner in the Rights Offering and the TW Private Placement Units represent approximately 70% of all Units that will be issued by the Company, which Time Warner is obligated to purchase under the Purchase Agreement.

In total, the Company is offering 4,000,000 Units in the Rights Offering and TW Unit Private Placement, consisting of $400.0 million aggregate original principal amount of New Notes and Unit Warrants to purchase a total of 84,000,000 shares of Class A Common Stock.

Under the Purchase Agreement, Time Warner will also commit to purchase at the Subscription Price in a separate private offering to be closed contemporaneously with the Rights Offering (the "Backstop Private Placement") any and all remaining Units that are not purchased through the exercise of Rights in the Rights Offering. We refer to this commitment as the "Backstop Purchase Commitment." The exact amount of Units to be purchased by Time Warner pursuant to the Backstop Purchase Commitment (the "Backstop Units") will vary depending upon the number of Units purchased through the exercise of Rights in the Rights Offering by the Eligible Securityholders (other than Time Warner). If the Eligible Securityholders (other than Time Warner) do not purchase any Units in the Rights Offering, Time Warner will purchase all of the Units offered by the Company in the Rights Offering as well as the TW Private Placement Units, following which its economic ownership interest in the Company's Class A Common Stock would be approximately 78.7% on a fully diluted basis.

On February 28, 2014, the Company also entered into a term loan credit agreement (the "Time Warner Term Loan Agreement") with Time Warner. The Time Warner Term Loan Agreement provides that Time Warner will make a term loan (the "Time Warner Term Loan") to the Company as follows: (x) in the event of the closing of the Rights Offering, Backstop Private Placement and TW Unit Private Placement prior to May 29, 2014 (the "Bridge Date"), concurrently with that closing, Time Warner will make a term loan to the Company in the aggregate principal amount of $30.0 million that matures on December 1, 2017, or (y) if the Rights Offering, Backstop Private Placement and TW Unit Private Placement are not closed prior to the Bridge Date, on the Bridge Date, Time Warner will make a term loan to the Company in the aggregate principal amount equal to the sum of (i) the U.S. dollar equivalent of the aggregate principal amount of the Company's 11.625% Rate Notes due 2016 (the "2016 Fixed Rate Notes") outstanding, plus the early redemption premium thereon payable to the holders thereof upon discharge of the 2016 Fixed Rate Notes, in each case, as of the business day immediately prior to the Bridge Date using the Euro/U.S. Dollar spot exchange rate published in the Wall Street Journal (the "Refinancing Portion of the Term Loan") plus (ii) $30.0 million that matures on September 8, 2014 (the "Initial Term Loan Maturity Date"). In the event that the Rights Offering, the Backstop Private Placement and TW Unit Private Placement are closed after the Bridge Date but on or before the Initial Term Loan Maturity Date, the proceeds from the Rights Offering, Backstop Private Placement and TW Unit Private Placement will be used to repay the Refinancing Portion of the Term Loan, and the maturity date of the remaining amount of the Time Warner Term Loan will be extended to December 1, 2017. If the Rights Offering, Backstop Private Placement and TW Unit Private Placement have not been closed on or before the Initial Term Loan Maturity Date, the Company shall issue and deliver to Time Warner warrants to purchase 84,000,000 shares of Class A Common Stock (subject to adjustment in accordance with the terms thereof, the "Term Loan Warrants") and the Initial Term Loan Maturity Date will be extended to December 1, 2017. The Term Loan Warrants will be exercisable, subject to the approval by the shareholders of the Company of this Proposal 2, from the second anniversary of the issue date until the fourth anniversary of the issue date, at an exercise price of $1.00 per share, subject to the limited right of Time Warner to exercise the Term Loan Warrants earlier in order to maintain the TW Ownership Threshold (as defined below). The Term Loan Warrants represent the number of Unit Warrants Time Warner would have purchased at the closing of the Rights

Offering, Backstop Private Placement (assuming that no other Eligible Securityholders exercised Rights in the Rights Offering) and TW Unit Private Placement. Upon such extension of the Initial Term Loan Maturity Date and issuance of the Term Loan Warrants, Time Warner's obligations under the Purchase Agreement will be terminated.

In addition, under the Framework Agreement, Time Warner agreed to extend to the Company a revolving credit facility that matures on December 1, 2017 in the aggregate principal amount of $115.0 million (the "Time Warner Revolving Credit Facility") at the earlier of (a) the closing of the Rights Offering, Backstop Private Placement and TW Unit Private Placement or (b) the funding of the Time Warner Term Loan.

The Company intends to use the net proceeds from the exercise of Rights in the Rights Offering, the purchase of Units in the TW Unit Private Placement and in the Backstop Private Placement, if applicable, together with the proceeds from the Time Warner Term Loan, to redeem and repay in full the 2016 Fixed Rate Notes, including the early redemption premium and accrued interest thereon. Alternatively, if the Company is unable to close the Rights Offering prior to the Bridge Date, then the Company intends to redeem and repay in full all outstanding 2016 Fixed Rate Notes, including the early redemption premium and accrued interest thereon, with the proceeds from the Time Warner Term Loan.

In connection with the transactions contemplated by the Framework Agreement, the Company agreed to issue to Time Warner, subject to the terms of the Framework Agreement and of an escrow agreement, a warrant to purchase 30,000,000 shares of Class A Common Stock (subject to adjustment in accordance with the terms thereof, the "TW Initial Warrant") exercisable, subject to the approval by the shareholders of the Company of this Proposal 2, from the second anniversary of the issue date until the fourth anniversary of the issue date, at an exercise price of $1.00 per share, subject to the limited right of Time Warner to exercise the TW Initial Warrant earlier in order to maintain the TW Ownership Threshold (as defined below).

The TW Initial Warrant and all Unit Warrants issued to Time Warner pursuant to the Rights Offering, the TW Unit Private Placement and the Backstop Private Placement, if applicable, or, in the event the Rights Offering is not closed prior to the Initial Term Loan Maturity Date, the Term Loan Warrants issued pursuant to the Time Warner Term Loan Agreement may be exercised by Time Warner prior to the second anniversary of their issue date at such time and in such amounts as would allow Time Warner to own up to 49.9% of the outstanding shares of Class A Common Stock (including any shares attributed to Time Warner as part of a group under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") (the "TW Ownership Threshold")).

The Rights Offering and the issuance to Time Warner of the TW Initial Warrant and all Unit Warrants pursuant to the Rights Offering, the Backstop Private Placement and the TW Unit Private Placement or, if applicable, the Term Loan Warrants pursuant to the Time Warner Term Loan Agreement, as described in this Proposal 2, are subject to the approval by the Company's shareholders under NASDAQ Marketplace Rule 5635(d), as further described below.

Background and Reasons for the Rights Offering

Our attempts to increase television advertising prices in 2013 were met with significant resistance from certain advertisers and agencies in the Czech Republic. This resulted in a significant decline in revenues for 2013 compared to 2012. Looking forward, we expect the impact of the challenging environment in the Czech Republic to continue as we endeavor to attract back advertising clients while continuing to seek improvements in pricing compared to 2012. While we expect a significant improvement in Czech advertising revenues in 2014, we do not expect advertising revenues in the Czech Republic to reach 2012 levels in 2014. We anticipate a similar trend in our consolidated results for 2014, and expect to build upon them in 2015. Our financial situation in 2013 was also impacted by a

further decline in advertising revenues in the Slovak Republic due to the reaction to our pricing initiatives in the Czech Republic from clients who also advertise in the Slovak Republic. Furthermore, carriage fee negotiations in the Czech Republic during 2013 did not advance to the extent that we had expected. As a result, we continue to take actions to conserve cash, including targeted reductions to our operating cost base through cost optimization programs and restructuring efforts, the deferral of programming commitments and capital expenditures and the deferral or cancellation of development projects. We have also delayed the settlement of payment obligations with a number of key suppliers, including payments due under contracts for acquired programming, which has resulted in our accounts payable and accrued liabilities increasing to $296.4 million at December 31, 2013 compared to $255.7 million at December 31, 2012 and $240.0 million at December 31, 2011. Despite the expectation of significantly improved revenue and OIBDA (as defined below) performance in 2014, our cash interest costs and need to improve our payables position will result in increased operating cash outflows during 2014 compared to 2013. We expect that our cash flows from operating activities will continue to be insufficient to cover operating expenses and interest payments and we will need other capital resources this year to fund our operations, our debt service and other obligations as they become due, including the settlement of such deferred payment obligations.

We have evaluated options to improve our liquidity in light of our results for 2013, our outlook for 2014 and our plan to improve our payables position. In this respect, following the end of the third quarter of 2013 we began discussions with Time Warner regarding a potential capital transaction, including the potential issuance of debt, to address our liquidity position. Following the publication of our third quarter earnings, we held investor meetings with certain of our debt and equity investors. We subsequently explored the availability of other financing options, including equity financing, a combination of debt and equity financing and asset sales. Based on information received during our investor meetings and the exploration of our financing alternatives, we concluded that any financing involving equity was not viable without the upfront significant committed participation of Time Warner, which Time Warner did not provide. In addition, we received proposals from several potential purchasers regarding the acquisition of certain assets. The proposals we received, however, were from opportunistic purchasers who expected to purchase such assets at a substantial discount to the value of these businesses or such offers came with significant timing or execution risk.

On October 16, 2013, our Board of Directors established a special committee (the "Special Committee"), and charged the Special Committee with the authority to evaluate a potential financing transaction with Time Warner, as well as other financing alternatives available to the Company, to engage advisors, to negotiate directly or to monitor negotiations in connection with such potential financing transaction with Time Warner or other financing alternatives, and to make a recommendation to the disinterested directors with respect to a transaction. Over the course of the process, the Special Committee met on a number of occasions. In February 2014, at the conclusion of its review of the financing options available to the Company, which included discussions and negotiations with Time Warner regarding its participation in a potential capital transaction, including the issuance of debt, the Special Committee recommended to the disinterested directors that the Company undertake the financing transactions described in the prospectus relating to the Rights Offering, including the Rights Offering, the Backstop Private Placement, the TW Unit Private Placement, the Time Warner Term Loan and Time Warner Revolving Credit Facility. After consideration of these discussions and inquiries and in light of the continued severe pressure on our liquidity during the latter part of 2013 and our expectation that this will continue through 2014, our disinterested directors determined that the Rights Offering together with the other financing transactions with the participation of Time Warner was in the best interests of the Company and we entered into the Framework Agreement pursuant to which we and Time Warner committed, subject to the terms and conditions thereof, to undertake and facilitate the transactions described herein, including the Rights Offering, Backstop Private Placement and TW Unit Private Placement. The principal purpose of these financing transactions is to enhance our overall liquidity and cash flow by refinancing the remaining €273.0 million aggregate principal amount of the 2016 Fixed Rate Notes, which are cash pay indebtedness, with non-cash pay indebtedness including the New Notes (including the New Notes issuable in connection with the TW Unit Private Placement and the Backstop Private Placement), the Time Warner Term Loan and the Time Warner Revolving Credit Facility.

In evaluating a potential financial transaction with Time Warner, the disinterested directors also took into account various factors, including:

•the Company's needs for additional capital, liquidity and financial flexibility;

•analysis from the Company's financial advisor;

•alternatives available for raising capital on terms acceptable to the Company;

•contractual rights previously granted to Time Warner in respect of equity financings and asset dispositions and alternative transactions acceptable to Time Warner; and

•current economic and financial market conditions.

In conjunction with its review of these factors, the disinterested directors also reviewed the Company's history and prospects, including the Company's financial results, the Company's expected future earnings, the outlook in the Company's markets, and the Company's current financial condition.

We are seeking to raise up to $341.8 million in new indebtedness through the Rights Offering, an additional $58.2 million in new indebtedness through the TW Unit Private Placement and $30.0 million in new indebtedness through the Time Warner Term Loan to enable us to refinance the 2016 Fixed Rate Notes in the manner described in this Proposal 2 and for general corporate purposes. These transactions will significantly reduce the amount of cash interest to be paid in the coming years while providing sufficient liquidity to fund our operations and relieve pressure on our working capital position. Based on our current projections, if closed, these transactions will position the Company to be free cash flow positive beginning in 2015, and we expect to use this positive free cash flow to repay the amounts drawn under the Time Warner Revolving Credit Facility such that we may be able to repay the entire balance drawn at or prior to its maturity on December 1, 2017.

If the Rights Offering (including the Backstop Private Placement), TW Unit Private Placement and other financing transactions contemplated by the Framework Agreement are not closed, we will need other external sources of capital to continue our operations, including through other debt or equity financing transactions or asset sales, which may not be available or may not be available on acceptable terms. If these actions are not successful, and we are unable to continue to delay payments to some of our major suppliers, we will not have sufficient liquidity to continue to fund our operations in the middle of 2014.

NASDAQ Shareholder Approval Requirement

We are seeking shareholder approval of (i) the Rights Offering and (ii) the issuance to Time Warner of the TW Initial Warrant and all Unit Warrants pursuant to the Rights Offering, the Backstop Private Placement, and the TW Unit Private Placement or, if applicable, the Term Loan Warrants, in accordance with the NASDAQ Marketplace Rule 5635(d).

NASDAQ Marketplace Rule 5635(d) requires shareholder approval of the issuance of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock outstanding before the issuance for less than the greater of book or market value of the stock, other than in a public offering.

In the Rights Offering, Eligible Securityholders may only purchase whole Units, subject to the minimum subscription amount. As a result, if shareholders hold fewer than 62.0102 shares of the Company's Class A Common Stock on the Rights Offering record date, then such shareholders will not be able to satisfy the minimum subscription amount and will not be able to participate in the Rights Offering. Consequently, the Rights Offering is not deemed a public offering for purposes of NASDAQ Marketplace Rule 5635(d) and therefore requires shareholder approval pursuant to that rule.

The Company has agreed to issue to Time Warner (a) the TW Initial Warrant to purchase 30,000,000 shares of Class A Common Stock (subject to adjustment as provided therein), and (b) (i) up to 84,000,000 Unit Warrants, with each Unit Warrant entitling it to purchase one (1) share of Class A Common Stock (subject to adjustment as provided therein) at an exercise price of $1.00 per share pursuant to Units Time Warner acquires in the Rights Offering, TW Unit Private Placement and the Backstop Private Placement, if applicable, or (ii) alternatively, if the Rights Offering, TW Unit Private Placement and Backstop Private Placement are not closed prior to the Initial Term Loan Maturity Date, 84,000,000 Term Loan Warrants to purchase one (1) share of Class A Common Stock (subject to adjustment as provided therein) at an exercise price of $1.00 per share pursuant to the Time Warner Term Loan Agreement (the warrants described in clauses (a) and (b) together, the "Warrants"). Because the Company has agreed to issue to Time Warner an amount of Warrants that could be convertible into more than 20% of our Class A Common Stock outstanding before the issuance at a price that is lower than the book value of our outstanding shares of Class A Common Stock (which is greater than the market value), we are seeking shareholder approval pursuant to Rule 5635(d).

Summary of Terms of Transaction Agreements and Warrants

The following is a summary of material terms and provisions of the material agreements relating to the transactions and the Warrants described in this Proposal 2. These summaries do not purport to be complete descriptions of all the terms of such agreements. The descriptions of the Framework Agreement, the Time Warner Term Loan Agreement, the Time Warner Revolving Credit Facility, the Purchase Agreement and the Warrants in this Proposal 2 are qualified in their entirety by reference to the complete text of the Framework Agreement, the Time Warner Term Loan Agreement, the Time Warner Revolving Credit Facility, the Purchase Agreement, the TW Initial Warrant Agreement (as defined herein), Private Placement Warrant Agreement (as defined herein) and the Unit Warrant Agreement (as defined herein), as applicable. You are urged to read each agreement in its entirety. You can find the Framework Agreement, the Time Warner Term Loan Agreement, the Time Warner Revolving Credit Facility and forms of each of the Warrants in the Registration Statement. The Registration Statement and other documents filed by us with the SEC are available for no charge at the SEC's website at http://www.sec.gov.

Framework Agreement

Under the Framework Agreement, the Company and Time Warner committed, subject to the terms and conditions thereof, to undertake and facilitate the financing transactions described in this Proposal 2, including the Rights Offering, Backstop Private Placement, TW Unit Private Placement, the Time Warner Term Loan and the Time Warner Revolving Credit Facility and certain related undertakings, including the following:

1.Subject to the effectiveness of the Registration Statement and the consent described below, the Company will conduct a rights offering (the "Rights Offering") to offer holders of our outstanding shares of our Class A Common Stock, our Series A Preferred Stock, and our Series B Preferred Stock rights to subscribe for 3,418,467 Units at a subscription price of $100.0 per Unit, which consists of (a) one New Note in the original principal amount of $100.0 and (b) 21 Unit Warrants, with each Unit Warrant entitling the holder thereof to purchase one share of Class A Common Stock exercisable from the second to the fourth anniversary of the date of issuance at an exercise price of $1.00 per share, subject to the limited right of Time Warner to exercise Unit Warrants earlier in order to maintain the TW Ownership Threshold.

2.Pursuant to a Standby Purchase Agreement (as described below) with the Company to be entered into at the commencement of the Rights Offering, TW BV will commit to (a) exercise

its subscription privilege in the Rights Offering, (b) purchase 581,533 Units in the TW Unit Private Placement, and (c) provide the Backstop Purchase Commitment.

3.Following execution of the Framework Agreement, the Company's wholly-owned subsidiary CET 21 spol. s r.o. conducted a consent solicitation (the "Consent Solicitation") in respect of certain amendments the indenture governing its 9.0% Senior Secured Notes due 2017 (the "2017 Fixed Rate Notes"), including to permit the incurrence of indebtedness in the financing transactions contemplated by the Framework Agreement, which Consent Solicitation was successfully completed on March 11, 2014.

4.The Company shall issue the TW Initial Warrant (as described below) to purchase 30,000,000 shares of Class A Common Stock on the earlier to occur of (i) the closing of the Rights Offering, the Backstop Private Placement and the TW Unit Private Placement, (ii) the funding of the Time Warner Term Loan and (iii) certification by TW BV of an uncured breach of the Framework Agreement by the Company.

5.Time Warner will make available a loan under the Time Warner Term Loan Agreement (as described below).

6.Time Warner will make available to the Company a senior secured revolving credit facility under the Time Warner Revolving Credit Facility Agreement (as described below) in the aggregate principal amount of $115.0 million, from the earlier of (a) the closing of the Rights Offering, Backstop Private Placement and TW Unit Private Placement or (b) the funding of the loan under the Time Warner Term Loan, which matures on December 1, 2017.

7.The Company will apply proceeds from the Rights Offering, Backstop Private Placement, TW Unit Private Placement and the Time Warner Term Loan to redeem and discharge the 2016 Fixed Rate Notes.

On the closing of the Rights Offering, the Company expects to issue $400.0 million aggregate principal amount of the New Notes and 84.0 million Unit Warrants. The closing of the Rights Offering is subject to the approval of the shareholders of the Company of this Proposal 2.

Currently, the Company's Board of Directors consists of seven (7) directors, with one (1) director designated by Time Warner. On the earlier to occur of (a) the mailing of the notice for the Company's 2014 annual general meeting, (b) the funding of the Time Warner Term Loan and (c) April 15, 2014, the size of the Company's Board of Directors shall be not more than eleven (11) directors, with one (1) less than the majority in number of such directors designated by Time Warner, who shall be duly appointed to the Board of Directors as a condition to the completion of the financing transactions contemplated by the Framework Agreement.

The Framework Agreement contains representations and warranties by the Company relating to, among other things, corporate organization, capitalization, due authorization of the agreement and other transaction agreements, compliance with laws, no conflicts and third party approval rights.

The Company and Time Warner each have the right to terminate the Framework Agreement if any governmental entity has issued an injunction prohibiting the consummation of any of the agreements or transactions contemplated by the Framework Agreement, if the non-terminating party materially breaches the terms of the Framework Agreement and such breach is not cured within 15 business days of notice thereof, by mutual written consent, or if the Consent Solicitation has not been successfully completed on or prior to a date mutually agreed upon by the Company and Time Warner.

Purchase Agreement

Pursuant to the Framework Agreement, Time Warner agreed to enter into the Purchase Agreement with the Company, subject to the conditions summarized below, prior to the

commencement of the Rights Offering. Pursuant to the Purchase Agreement, Time Warner will commit to exercise in full its subscription privilege at the Subscription Price in respect of all of the Rights allocated to Time Warner in the Rights Offering in respect of its shares of Class A Common Stock, Series A Preferred Stock and Series B Preferred Stock. In addition, the Company will agree to issue to Time Warner, and Time Warner will agree to purchase, 581,533 TW Private Placement Units at the Subscription Price in the TW Unit Private Placement. The TW Private Placement Units are not included in the 3,418,467 Units that the Company is offering in the Rights Offering. In total, the Company intends to offer 4,000,000 Units in the Rights Offering and TW Unit Private Placement. The Rights allocated to Time Warner in the Rights Offering and the TW Private Placement Units represent approximately 70% of all Units that will be issued by the Company, which Time Warner is obligated to purchase under the Purchase Agreement.

The Purchase Agreement will contain representations and warranties by the Company relating to, among other things, corporate organization, capitalization, due authorization of the Backstop Units and of the agreement, compliance with laws, no conflicts and third party approval rights.

Time Warner's obligations under the Purchase Agreement will be subject to customary conditions, including, but not limited to, the following: (a) no material adverse effect on the Company and its subsidiaries shall have occurred since the date of the Framework Agreement; (b) the accuracy of the Company's representations and warranties contained in the Purchase Agreement; (c) all covenants and agreements contained in the Purchase Agreement to be performed by us shall have been performed and complied with in all material respects; (d) the Time Warner Term Loan shall have been funded at the earlier of the closing of the Rights Offering or the Bridge Date; (e) receipt of the approval by the shareholders of the Company of Proposal 1 and this Proposal 2, (f) the size of the Company's Board of Directors shall be not more than eleven (11), with one (1) less than the majority in number of such directors designated by Time Warner, who shall be duly appointed to the Board of Directors; (g) the closing of the Rights Offering, TW Unit Private Placement and Backstop Private Placement in accordance with the terms and conditions set forth in the Purchase Agreement and the Registration Statement, (h) the effectiveness of the Registration Statement containing the prospectus relating to the Rights Offering, and (i) the closing of the Consent Solicitation (which occurred on March 11, 2014).

The Company and Time Warner each will have the right to terminate the Purchase Agreement if any governmental entity has issued an injunction prohibiting the consummation of the transactions contemplated by the Framework Agreement, if the non-terminating party materially breaches the terms of the Framework Agreement and such breach is not cured within 15 business days of notice thereof, or by mutual written consent.

Time Warner Term Loan Agreement

On February 28, 2014, the Company and Time Warner entered into the Time Warner Term Loan Agreement. The Time Warner Term Loan Agreement provides that Time Warner will make the Time Warner Term Loan to us as follows: (x) in the event of the closing of the Rights Offering, the Backstop Private Placement and the TW Unit Private Placement prior to the Bridge Date, concurrently with those closings, Time Warner will make the Time Warner Term Loan to us in the aggregate principal amount of $30.0 million that matures on December 1, 2017, or (y) if the Rights Offering, the Backstop Private Placement and the TW Unit Private Placement are not closed prior to the Bridge Date, on the Bridge Date, Time Warner will make the Time Warner Term Loan to us in the aggregate principal amount equal to the sum of (i) the Refinancing Portion of the Term Loan plus (ii) $30.0 million that matures on the Initial Term Loan Maturity Date; provided that, if the Rights Offering, the Backstop Private Placement and the TW Unit Private Placement are closed after the Bridge Date but prior to the Initial Term Loan Maturity Date, we will apply the proceeds therefrom to repay the Refinancing Portion of the Term Loan and any accrued interest thereon, with any accrued interest thereon in excess of such proceeds to be repaid by us from the proceeds of the Time Warner Term Loan or the Time

Warner Revolving Credit Facility, and the maturity date of the remaining $30.0 million of the Time Warner Term Loan will be extended to December 1, 2017; provided, further, if the Refinancing Portion of the Term Loan together with accrued interest thereon has not been prepaid on or prior to the Initial Term Loan Maturity Date in the manner set forth above, we shall issue and deliver to Time Warner the Term Loan Warrants and upon such issuance, the Initial Term Loan Maturity Date will be extended to December 1, 2017.

Amounts outstanding under the Time Warner Term Loan Agreement will bear interest at a rate of 15.0% per annum payable semi-annually in arrears. The Company may pay all accrued interest for an interest period fully in cash or by adding such amount to the principal amount of the Time Warner Term Loan (a "Term Loan PIK Election"). If we do not make an election in the manner set forth in the Time Warner Term Loan Agreement, a Term Loan PIK Election will be deemed to have been made for the entire principal amount of the outstanding Time Warner Term Loan with respect to such interest payment date.

The Time Warner Term Loan Agreement contains restrictive covenants usual and customary for facilities of its type, which include, with specified exceptions, limitations on our ability to engage in certain business activities, incur indebtedness, incur guarantees, have liens, pay dividends or make other distributions, enter into affiliate transactions, consolidate, merge or effect a corporate reconstruction, make certain investments, acquisitions and loans, conduct certain asset sales and amend constitutional documents and certain debt documents in a manner adverse to the lenders in any material respect. We are required to comply with certain of these covenants from the date hereof, while we are not required to comply with others until the Time Warner Term Loan is made. Beginning with the first full accounting quarter occurring after the Time Warner Term Loan is made, we will be required to satisfy specified financial covenants, such as maintaining a cashflow cover ratio of no less than 0.30 to 1.00, an interest cover ratio of no less than 0.09 to 1.00 and a consolidated total leverage ratio of no more than 110.00 to 1.00. The cashflow cover ratio and the interest cover ratio will be subject to step-ups at certain dates in the future, and the consolidated total leverage ratio will be subject to step-downs at certain dates in the future.

Central European Media Enterprises N.V. ("CME NV") and CME Media Enterprises B.V. ("CME BV") will be guarantors of borrowings under the Time Warner Term Loan Agreement. Subject to the Intercreditor Agreement originally dated as of July 21, 2006 (as amended and restated from time to time and to be amended and restated on the issue date for the New Notes, the "CME Intercreditor Agreement"), the Time Warner Term Loan Agreement will have a lien on all of CME NV's and CME BV's capital stock.

The Time Warner Term Loan Agreement will not require any scheduled principal payments prior to the maturity date. The Time Warner Term Loan Agreement may not be prepaid prior to the Initial Term Loan Maturity Date unless such prepayment is made solely with the proceeds of the Rights Offering, the Backstop Private Placement and the TW Unit Private Placement. After the Initial Term Loan Maturity Date, to the extent the New Notes are outstanding, the Time Warner Term Loan Agreement may be prepaid in whole, but not in part, as long as the New Notes are concurrently repaid and discharged. After the Initial Term Loan Maturity Date, the Time Warner Term Loan Agreement may be prepaid in whole or in part if the Refinancing Portion of the Term Loan has not been repaid with the proceeds of the Rights Offering, Backstop Private Placement and TW Unit Private Placement prior to such date. Notwithstanding the foregoing, the Time Warner Term Loan is required to be repaid pro rata with other indebtedness of the Company following certain asset dispositions. In addition, in the event that the 2017 Fixed Rate Notes are prepaid in full or repaid in full, the Time Warner Term Loan will become immediately due and payable.

In the event of an "event of default" under the indenture governing the New Notes, the indenture governing the 2017 Fixed Rate Notes and the indenture governing the 2015 Convertible Notes, an

event of default will occur under the Time Warner Term Loan Agreement. In addition, in the event of a specified "change in control", an event of default will occur under the Time Warner Term Loan Agreement.

We will be obligated to pay to Time Warner a commitment fee of 1.25% of the entire Time Warner Term Loan and, if we drawdown the Refinancing Portion of the Term Loan, a funding fee of 1.25% of the total amount of the Refinancing Portion of the Term Loan, a portion of which funding fee may be refunded to us depending on when we repay the Refinancing Portion of the Term Loan.

Time Warner Revolving Credit Facility

Under the Framework Agreement, Time Warner also agreed to extend to us the Time Warner Revolving Credit Facility in the aggregate principal amount of $115.0 million at the earlier of (a) the closing of the Rights Offering, the Backstop Private Placement and the TW Unit Private Placement or (b) the funding of the Time Warner Term Loan. Borrowings under the Time Warner Revolving Credit Facility will be used for general corporate purposes.

On the closing date of the Time Warner Revolving Credit Facility, amounts outstanding under the Time Warner Revolving Credit Facility will bear interest at a rate based on, at the Company's option, the alternative base rate plus 13% or the adjusted LIBO rate plus 14%. The alternative base rate is defined as the highest of (i) the published corporate base rate of interest as chosen by the administrative agent from time to time in its sole discretion, (ii) the federal funds effective rate plus 0.50% and (iii) the sum of (a) the one month adjusted LIBO rate plus (b) 1.00%. With respect to all of the outstanding principal amount of the Time Warner Revolving Credit Facility, the Company may pay all accrued interest for an interest period fully in cash or by adding such amount to the principal amount of the Time Warner Revolving Credit Facility (a "Revolver PIK Election"). If we do not make an election in the manner set forth in the Time Warner Term Loan Agreement, a Revolver PIK Election will be deemed to have been made for the entire principal amount of the outstanding Time Warner Revolving Credit Facility with respect to such interest payment date. Additionally, the Time Warner Revolving Credit Facility will contain a commitment fee on the average daily unused amount under the facility of 0.50% per annum.

Ongoing extensions of credit under the Time Warner Revolving Credit Facility will be subject to customary conditions. The Time Warner Revolving Credit Facility will contain restrictive covenants usual and customary for facilities of its type, which include, with specified exceptions, limitations on our ability to engage in certain business activities, incur indebtedness, incur guarantees, have liens, pay dividends or make other distributions, enter into affiliate transactions, consolidate, merge or effect a corporate reconstruction, make certain investments, acquisitions and loans, conduct certain asset sales and amend constitutional documents and certain debt documents in a manner adverse to the lenders in any material respect. The Time Warner Revolving Credit Facility will also require us to satisfy specified financial covenants, such as maintaining a cashflow cover ratio of no less than 0.30 to 1.00, an interest cover ratio of no less than 0.09 to 1.00 and a consolidated total leverage ratio of no more than 110.00 to 1.00. The cashflow cover ratio and the interest cover ratio will be subject to step-ups at certain dates in the future, and the consolidated total leverage ratio will be subject to step-downs at certain dates in the future.

CME NV and CME BV will be guarantors of borrowings under the Time Warner Revolving Credit Facility. Subject to the CME Intercreditor Agreement, the Time Warner Revolving Credit Facility will have a lien on all of CME NV's and CME BV's capital stock.

The Time Warner Revolving Credit Facility will not require any scheduled principal payments prior to the maturity date. In the event of an "event of default" under the indenture governing the New Notes, the indenture governing the 2017 Fixed Rate Notes Indenture and the indenturing governing the 2015 Convertible Notes, an event of default will occur under Time Warner Revolving Credit Facility. In

addition, in the event of a specified "change in control", an event of default will occur under the Time Warner Revolving Credit Facility.

The Time Warner Revolving Credit Facility will mature on December 1, 2017. In the event that either the Time Warner Term Loan or the New Notes are prepaid in full or repaid in full, the commitments under the Time Warner Revolving Credit Facility will automatically terminate and all loans outstanding will become immediately due and payable at such time.

Terms of the Warrants

The TW Initial Warrant will be issued to Time Warner in connection with the transactions contemplated by the Framework Agreement. The warrants acquired by TW BV pursuant to the Purchase Agreement ("Private Placement Warrants") will be issued to TW BV in connection with the purchase of Units in the TW Private Placement and the Backstop Private Placement, if applicable. The Term Loan Warrants will be issued in the event the Rights Offering, Backstop Private Placement and TW Unit Private Placement are not completed prior to the Initial Term Loan Maturity Date. A summary of the terms of the Warrants is set forth below.

The TW Initial Warrant will be exercisable for 30,000,000 shares of Class A Common Stock (subject to adjustment in accordance with the terms thereof). The Private Placement Warrants will be exercisable for up to 84,000,000 shares of Class A Common Stock (subject to adjustment in accordance with the terms thereof), in the event that no other Eligible Securityholder (other than Time Warner) subscribes for Units. If the Rights Offering, Backstop Private Placement and TW Unit Private Placement and are not completed prior to the Initial Term Loan Maturity Date, the Term Loan Warrants will be issued and exercisable for 84,000,000 shares of Class A Common Stock.

Each of the TW Initial Warrant, the Private Placement Warrants and the Unit Warrants or, if applicable, the Term Loan Warrants, will be exercisable for $1.00 per share, subject to certain adjustments described below. The Warrants are non-redeemable.

The Warrants may be exercised at any time starting on the second anniversary of the applicable date of issuance until the fourth anniversary after such date of issuance, subject to the limited right of Time Warner to exercise the Warrants earlier in order to maintain the TW Ownership Threshold.

Notwithstanding the foregoing, Time Warner shall not have any right to acquire shares of Class A Common Stock upon exercise of the Warrants until the date that is 61 days after the earlier of: (a) the date on which the number of outstanding shares of Class A Common Stock owned by Time Warner, when aggregated with any outstanding shares of Class A Common Stock held by any group (as this term is used in Section 13(d)(3) of the Exchange Act) that includes Time Warner and any of its affiliates, would not result in the holder of such Warrant being a beneficial owner (as such term is used in Section 13(d)(3) of the Exchange Act) of more than 49.9% of the outstanding shares of Class A Common Stock, and (b) the date on which such holder's beneficial ownership would not give to any person or entity any right of redemption, repurchase or acceleration under any indenture or other document governing any of the Company's indebtedness that is outstanding as of the date of issuance of the applicable Warrant. The Warrants will be adjusted as necessary to protect holders from the dilutive effects of (a) subdivisions, reclassifications, combinations and similar transactions, (b) certain repurchases of shares of the Company's Class A Common Stock pursuant to a tender offer or exchange offer, or other offer available to substantially all holders of the Company's Class A Common Stock, at a price above the market price for the Company's shares of Class A Common stock, and (c) certain business combinations. Unless a distribution is made in connection with a business combination, if there is a distribution to the holders of Class A Common Stock (other than pursuant to a subdivision, reclassification, combination and similar transaction), upon exercise of a Warrant, the holder of the Warrant will receive the amount of such distribution the holder would have on the date of exercise as if

the holder had been a record holder of Class A Common Stock on the date of such distribution, in addition to the number of shares of Class A Common Stock receivable upon exercise.